How To Choose Travel Insurance?

The Tortuga Promise

At Tortuga, our mission is to make travel easier. Our advice and recommendations are based on years of travel experience. We only recommend products that we use on our own travels.

Table of Contents

Don’t travel in fear that something might go wrong, because, spoiler: it totally will. If you have travel insurance—with the right kind of coverage for your trip—you won’t have to sweat the small (or big) things.

When you fantasize about your “once in a lifetime trip to X” getting travel insurance doesn’t usually top your to-do list. I get that. The allure of adventure and the mystique of travel are all about throwing caution to the wind, baring your teeth at the indifferent universe and flinging yourself into the chaotic maw of happenstance and serendipity, right?

Actually, no it’s not. That’s an awful way to travel. Put down your copy of Hunter S. Thompson and pay attention. We’re going to break down what travel insurance covers (and doesn’t), costs, how to buy it, and tips to figure out how to choose travel insurance for your next trip.

Do You Need Travel Insurance?

While most trips won’t require you to have travel insurance, it’s a good idea to have, especially for international travel where your normal health, auto, and home owner’s insurances may not cover you. Travel insurance is a low cost security blanket that covers you if the worst happens. And while coverage can vary, getting the bare minimum travel insurance is worth it in case of emergencies—both big and small.

The one exception: travel insurance is actually mandatory if you’re applying for a work, or holiday visa, or studying abroad.

Getting robbed and stranded in a foreign country isn’t awesome—it’s stupid. Things go wrong when you travel. Sh*t happens. And while it’s important to keep your wits about you and problem solve the inevitable pitfalls that occur on the road, one of your best arrows in your adventure quiver is travel insurance.

What Does Travel Insurance Cover?

Travel insurance coverage varies, but it typically breaks down into three broad areas of coverage:

- Medical: This will cover you in the case of a medical emergency, such as a broken leg.

- Property: This can help you if your property is stolen or damaged.

- Travel: This helps you with trip-related hiccups, such as a last-minute trip cancellation or lost baggage.

Even though we fixate on the medical side of travel insurance—and it can be the most costly emergency expense if something goes wrong abroad—you’re far more likely to use your insurance (aka “make a claim”) for lost or stolen items or trip interruptions. People lose stuff. Schedules change. Keep that in mind before you purchase a platinum medical insurance package that doesn’t cover your DSLR.

Basic vs. Premium Travel Insurance

Travel insurance typically falls into either basic or premium coverage. Companies add a lot of bells and whistles—like 24-hour support lines—but the difference between a basic and premium travel insurance plan is almost always higher monetary limits. For example, damage to your gear, trip interruption reimbursement, and medical coverage limits could be $100,000 vs. $1,000,000 for example.

Basic Travel Insurance Coverage

Basic coverage obviously varies, but typically basic travel insurance covers at least:

- $1,000 Baggage

- $2,000 Trip cancellation

- $1,000 Trip interruption

- $50,000 Medical care

- $50,000 Medical evacuation

Basic plans usually don’t cover:

- Rental car insurance

- Missed connections

- Delayed baggage

- Pre-existing conditions

- Dental

If you’re a hostel backpacker with a rail pass (i.e. no rental car), basic coverage is almost always the way to go.

Premium Travel Insurance Coverage

No matter what they call it—’Luxe, Preferred, Platinum—premium coverage offers all the protection of basic plans, with increased limits for nearly every category. If you want “good” premium coverage look for numbers in these ranges:

- $3,000 Baggage

- $10,000 Trip cancellation

- $10,000 Trip interruption

- $1,000 Missed connection

- $100,000 Medical care

- $500,000 Medical evacuation

- $50,000 Dental

- $35,000 Rental car collision waiver

Certain countries, sports, and activities are rarely covered even under the best insurance. Rock climbing in Thailand? Probably covered (but expensive). Skydiving. Eh. Maybe not. Scuba? Sometimes. World Nomads has a premium adventure package covering a TON of stuff, but they’re the exception to the rule.

How Much Does Travel Insurance Cost?

Travel insurance costs about $6-20 per day for a short trip (less than 2 weeks), and as little as $2 per day for longer trips (1 month+). However, costs can vary depending on your travel insurance provider and trip cost. Not bad for something that covers accidents, cancellations, theft, and more.

The secret to buying travel insurance is shopping around (it’s tedious, but worth it), and customizing coverage for your adventure.

The Best Travel Insurance to Choose From

Travel insurance can vary a lot by provider but we’ve reviewed and listed the best travel insurances to choose from.

Since cost is an important factor for travelers, I crunched the numbers for a 30-year old taking a two week trip that costs around $3,000. The list of travel insurance options goes from cheapest to most expensive:

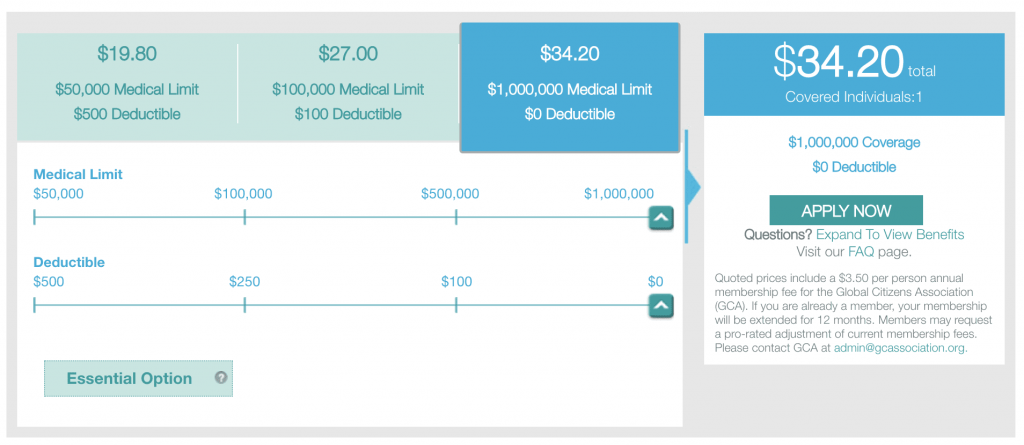

1. GeoBlue: Best for Medical Coverage

- Single Trip Voyager Basic: $19.80

- Single Trip Voyager Full: $34

At $19, Voyager basic medical coverage (the cheapest option) covers your medical expenses up to $50,000 and comes with a $500 deductible. This “break glass in case of emergency” type of coverage is great for covering your butt, but odds are you aren’t going to exceed that $500 deductible (unless something goes really wrong).

This is basically a $20 piece of paper that says if you need a helicopter to air lift you to the hospital, you’re only going to have to pay $500 bucks. Not great, but way better than nothing.

For just another $1/day you can get full medical coverage up to one million bucks, with $0 deductible. Opt for the upgrade. The price of a pizza can save you thousands if you have an accident.

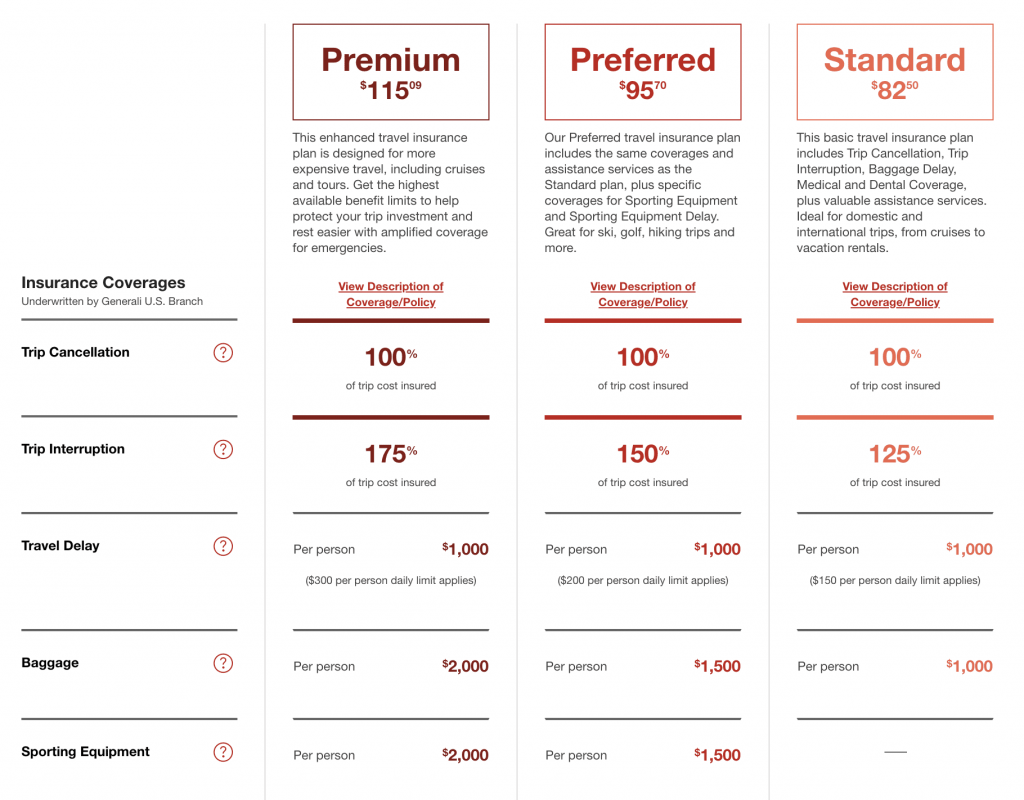

2. Generali: Best for Basic Coverage

- Standard: $82.50

- Preferred: $95.70

- Premium: $115.09

Generali’s basic plan doesn’t cover pre-existing conditions, rental cars, or accidental death and dismemberment. So don’t die. But other than that, it’s actually pretty comprehensive coverage.

On the plus side, all plans include dental in the medical coverage (up to $50,000), which is a big deal if you chip your tooth on a Red Bull can. Also, they have a new “identity theft” resolution, which probably means nothing, but it feels good.

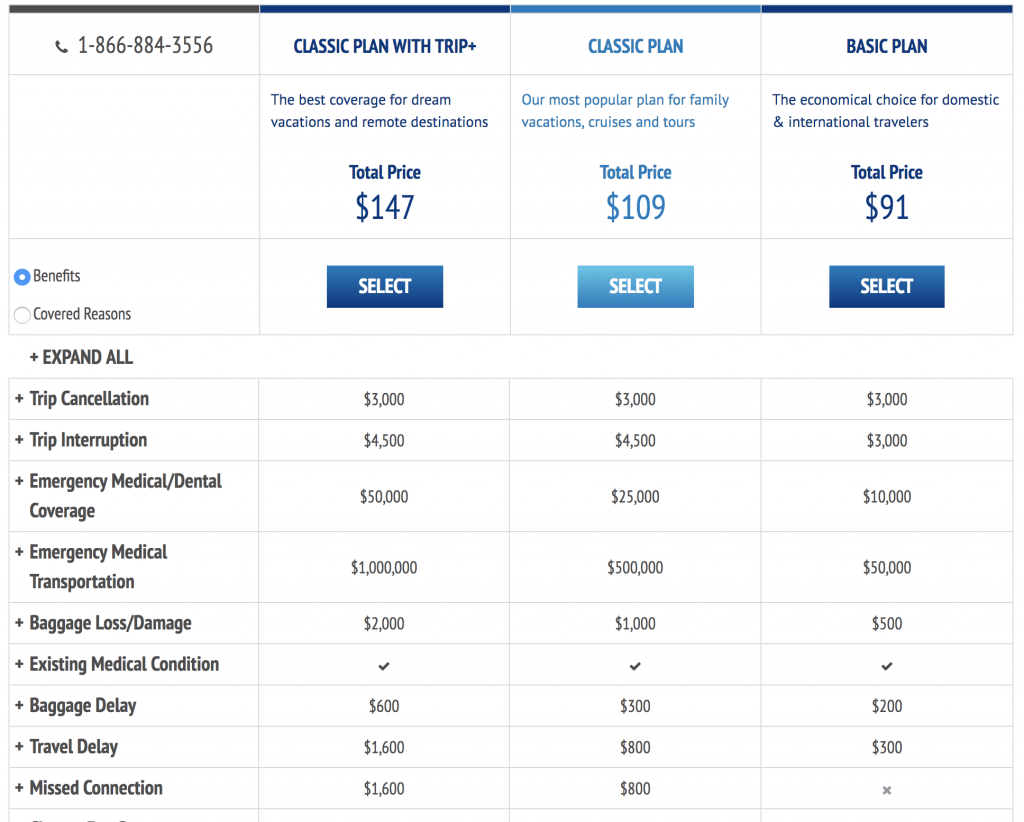

3. Allianz: Best for Older Travelers and Those With Pre-Existing Conditions

- Basic: $91

- Classic: $109

- Trip+: $140

Allianz is one of the best travel insurances out there. All of their plans now how great emergency medical coverage. $50,000 is now the base coverage, going all the way up to $1,000,000. Pre-existing conditions are covered on every plan.

The key difference between their plans now isn’t medical, but lost luggage. Baggage loss/damage is on the low side ($500, $1,000, and $2,000). If you travel with expensive electronics, like a laptop, the Basic package might not give you any real coverage. Also, Basic coverage doesn’t provide reimbursement for missed connections, and travel delay coverage is low ($300). I’d upgrade this plan to premium without a second thought.

4. World Nomads: Best for Adventure Travelers

- Standard: $93.71

- Explorer: $138.59

The medical coverage is the same ($100,000) on both plans, and neither plan covers pre-existing conditions. Trip cancellation, rental cars, and property coverage are the main differentiators.

Trip cancellation is $2,500 for Standard and $10,000 for Explorer. For gear, Standard covers up to $1,000 of gear, while Explorer goes up to $3,000. Again, if you have expensive camera gear or a laptop, it’s worth upgrading to the Explorer plan. Finally, the Explorer plan has rental car coverage but the Standard does not.

World Nomads is the best travel insurance for adventure sports coverage. Explorer covers 100+ activities like: skydiving, base jumping, and even shark cage diving. So that’s sweet. Standard covers almost as many including, climbing and canoeing. Both plans also include dental—but only $750, which is better than nothing.

Mature Travelers: World Nomads doesn’t cover people over 70 years old, but Allianz does!

5. HTH Travel: Best for Just-in-Case-You-Need-to-Cancel

- Economy: $110

- Classic: $126

- Preferred: $150

A (hypothetical) 30-year old traveler with an estimated trip cost of $3,000 can expect to pay about $20/day, which is pretty reasonable for everything you get with this insurance.

The biggest differences between the three levels is a jump in total medical coverage ($75,000, $250,000, $500,000) and lost luggage reimbursement ($750, $1,000, $2,000). If you’re traveling with a lot of expensive camera gear (and who isn’t these days), get the Preferred Travel Insurance.

It might seem small, but the jump from $750 to $2,000 for lost or damaged items is actually far more significant than the $75,000 to $500,000 medical insurance bump. You’re more likely to break your camera, than your leg, and $75,000 is already pretty hefty medical insurance.

There are a few more subtle differences between the levels if you want to get granular. You can add “cancel any time trip” cancellation to Preferred coverage for an extra $75, but each plan already has a built in trip cancellation sliding scale ($5,000 up to $50,000). Economy doesn’t have “missed connection” reimbursement, and only Preferred provides car rental insurance coverage, so you’ll need to see which works best for you.

Plus Side: Each option includes more than 100% reimbursement (125%, 150%, and 200%) for “trip interruption” which is pretty great. That basically means, that HTH understands that missing out an activity is about more than just the money out of pocket—it’s about putting a price on missing out on a once-in-a-lifetime experience. So if you miss that African safari, you might actually make a little money to numb the sting.

Can You Get Travel Insurance With a Credit Card?

Yes. Depending on your credit card, you might already have travel insurance. About 15% of credit cards have built in travel insurance (aka trip interruption insurance), so call your credit card company and check. Below are a list of credit cards with the best travel insurance coverage:

1. Chase Sapphire

Chase has one of the best credit card travel insurance plans, with Sapphire members getting trip cancellation and interruption insurance for “severe weather.” It’s not great, but it’s something. You can even get up to $10,000 back per trip for “prepaid, non-refundable travel expenses, like flights, tours, and hotels.”

Bonus: If your flight is delayed more than 12 hours, or requires an overnight stay at a hotel, Chase will pay for meals and lodging of up to $500 per passenger. Which is awesome.

2. Citi Credit Cards

Citi provides trip cancellation and interruption protection for severe illness or weather-related reasons and non-refundable expenses may be reimbursed, including change fees. You can even get back up to $5,000 for “non-refundable trip expenses” if you bought the trip with the Citi card.

4. Amex

One possibility is to buy travel insurance through American Express—just like the other travel insurance providers. Basic coverage starts at $59 for our hypothetical 30-year old on a 2-week trip.

The plan isn’t awesome (baggage coverage is only $250), but it includes decent medical and dental coverage, and American Express offers trip cancellation insurance (if you bought your trip with your card) for bad weather, natural disasters, and if you or a family member are unexpectedly and seriously sick or injured.

Bonus: Labor disputes that affect travel services are covered, so get this coverage if you go to France. Seriously though.

How to Choose Your Travel Insurance

After reviewing the best travel insurance providers and settling on a few that are within your price range, here’s how to choose which travel insurance is right for your trip:

Decide How Much Medical Coverage You Need

If medical coverage—hospital bills, medical evacuation, zero deductible, etc.—is all that matters, get a well-reviewed insurance package with at least $250,000 in coverage, like Allianz. Also check your home health insurance plan. Some will cover you overseas and if yours does, medical coverage may not even matter with your travel insurance.

If You Have Expensive Gear, Look for High Baggage Loss/Theft Coverage

If you’re concerned about your gear, find a plan with no Per Article Limits and high Baggage Loss/Theft coverage ($3,000-$5,000).

Typically, most “Basic” packages have a claim limit of $1,000, which just isn’t enough for all my fancy pants stuff. But it all depends on you. If you’re a t-shirt and paperback traveler, skip the spinning rims and stick with basic coverage. The medical coverage is usually about the same ($50,000-$100,000).

What is a Per Article Limit?

Watch out for one insidious insurance term: Per Article Limit. A low per article limit—say, $100—on your policy means that even though your gear may be covered up to $5,000 (a very high limit), you can only claim $100 for each lost or stolen item. Per article limits are absolute crap. Avoid them.

Protect Your Itinerary with Trip Cancellation, Interruption, or Missed Connection Clauses

If you’ve pre-booked your entire trip, and some of the connections are tight, or you’ve been reading a lot about monsoon season and you’re starting to freak out, make sure you have an iron clad trip cancellation and trip interruption clause. Taking a cruise? Make sure you’re covered by a missed connection clause for the value of your cruise.

Not sure what you need? Here’s the difference between trip cancellation vs. trip interruption vs. missed connection:

Trip Cancellation

If you have to cancel your trip before you leave home, usually because of illness, death of a loved one, or natural disasters (your Fiji hotel gets hit by a hurricane), a trip cancellation clause will cover you. A good cancellation policy is $10,000 and why some people buy their insurance months in advance.

Trip Interruption

This is when your trip hits a snag during your trip. It’s the most likely type of hassle. The rule of thumb here is to cover at least a week of travel that you’ve already prepaid for. $2,000-$3,000 is standard for basic plans, and quickly escalates for premium packages. It all depends on how fancy you are.

Missed Connection

This one is super tricky, so read the fine print. Often times the only reimbursement is for cruises, with some air travel thrown in. Usually a missed connection claim only works if the reason you miss your flight/cruise is because of bad weather. So if you oversleep, you’re probably S.O.L.

Extend Coverage As You Go

Extending your coverage is easy to do and they’ll practically drool if you say you want to up your protection mid-trip. The one thing you can’t do is downgrade.

If penny pinching is a huge concern, or you haven’t nailed down your budget and the thought of spending tons of cash up front bums you out, get basic coverage for the first leg of your trip and see how it goes, then upgrade or extend later. Try before you buy. You can always get more.